Payroll calculator wa

Discover ADP Payroll Benefits Insurance Time Talent HR More. The information provided by the Paycheck Calculator provides general information regarding the calculation of taxes on wages for Washington residents only.

Equivalent Salary Calculator By City Neil Kakkar

Get Started With ADP Payroll.

. Calculate your payroll tax liability Calculate your payroll tax liability This calculator can assist you with estimating your payroll tax liability. Enter up to six different hourly rates to estimate after-tax wages for hourly employees. Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly employees in Washington.

Plug in the amount of money youd like to take home. Below are your Washington salary paycheck results. Washington Salary Paycheck Calculator Change state Calculate your Washington net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state.

Take a Guided Tour. Pay employee premiums on their behalf. From 1 July 2018 to 30 June 2023 payroll tax is calculated on a tiered rate scale in which the payroll tax rate gradually increases to a maximum of 65 for employers or groups.

Multiply the result in Step 1. The results are broken up into three sections. Use this calculator to quickly estimate how much tax you will need to pay on your income.

Divide the actual numbers of hours worked by number of available hours in the pay cycle. Ad Process Payroll Faster Easier With ADP Payroll. Our Expertise Helps You Make a Difference.

This free easy to use payroll calculator will calculate your take home pay. Paycors Tech Saves Time. Ad Payroll So Easy You Can Set It Up Run It Yourself.

Washington Washington Gross-Up Calculator Change state Use this Washington gross pay calculator to gross up wages based on net pay. For example if you earn 2000week your annual income is calculated by. To calculate your annual salary multiply the gross pay before taxes by the number of pay periods in the year.

Withhold 765 of employee total wages and other compensation from employees paychecks use the same. Calculating your Washington state income tax is similar to the steps we listed on our Federal paycheck calculator. Enter your info to see.

This calculator is always up to date and conforms to official Australian Tax Office rates and. Washington Paycheck Calculator Use ADPs Washington Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. Get Started With ADP Payroll.

Ad The Best HR Payroll Partner For Medium and Small Businesses. Ad Process Payroll Faster Easier With ADP Payroll. Federal Social Security and Medicare taxes employee and employer paid.

Collect employee premiums OR. Simply enter their federal and state W-4 information. Ad Compare This Years Top 5 Free Payroll Software.

Pay Calculations To Determine Semi-Monthly Gross Pay. Washington Paycheck Calculator - SmartAsset SmartAssets Washington paycheck calculator shows your hourly and salary income after federal state and local taxes. Find The Best Payroll Software To More Effectively Manage Process Employee Payments.

It is not a substitute for the. Ad Join Thousands Of Other Business Owners Whove Made Their Payroll Management Easier. Free Unbiased Reviews Top Picks.

Paycheck Results is your gross pay and. Payroll tax is assessed on the wages. Washington Hourly Paycheck Calculator Change state Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local.

The Washington Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2022 and Washington. Ad See the Hours Tools your competitors are already using - Start Now. Discover ADP Payroll Benefits Insurance Time Talent HR More.

Of this employers with 50 employees will pay up to 2678 and employees will pay 7322. Figure out your filing status work out your adjusted gross. All Services Backed by Tax Guarantee.

Supports hourly salary income and multiple pay frequencies. For example if an employee receives 500 in. Read reviews on the premier Hours Tools in the industry.

Washington Salary Paycheck Calculator Results. Just enter the wages tax withholdings.

Washington Paycheck Calculator Smartasset

How To Do Payroll In Excel In 7 Steps Free Template

Washington Paycheck Calculator Smartasset

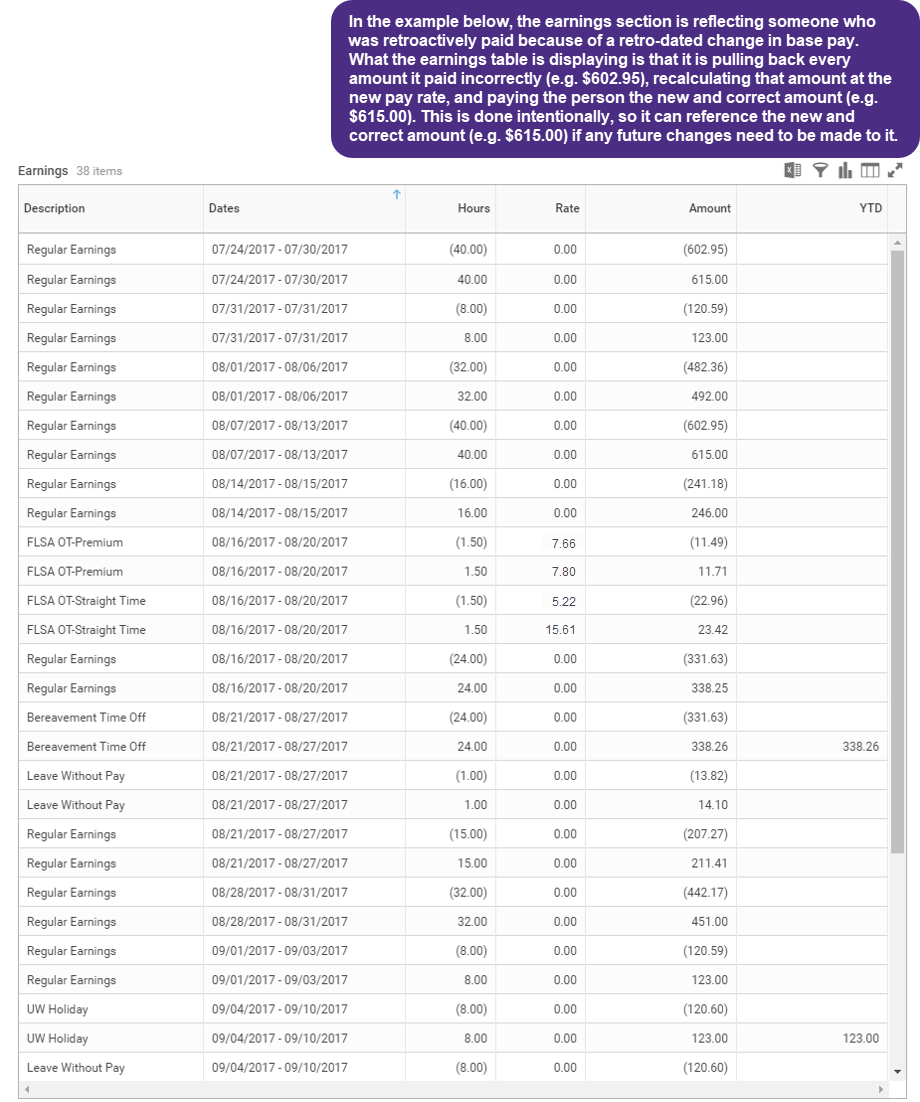

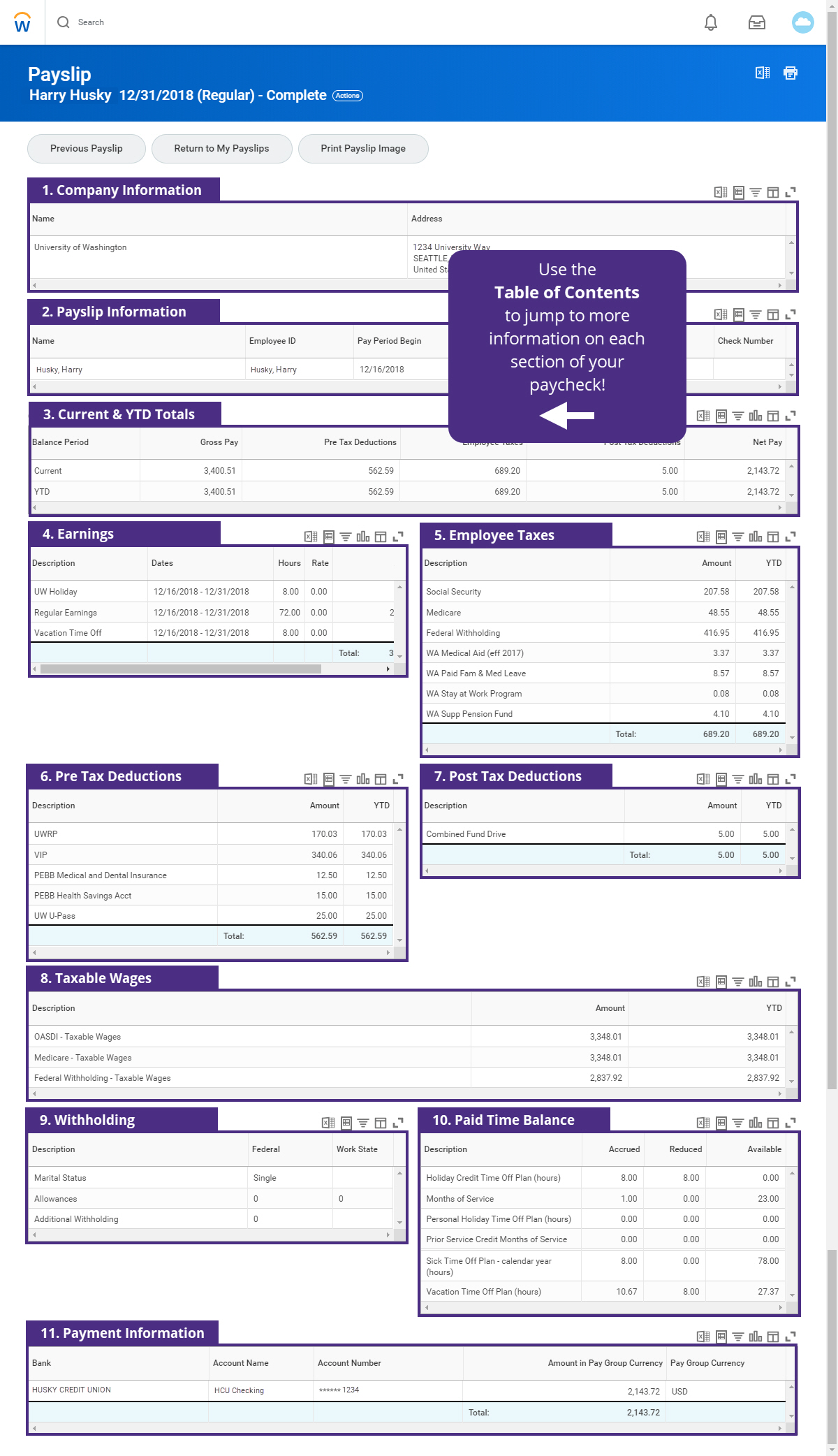

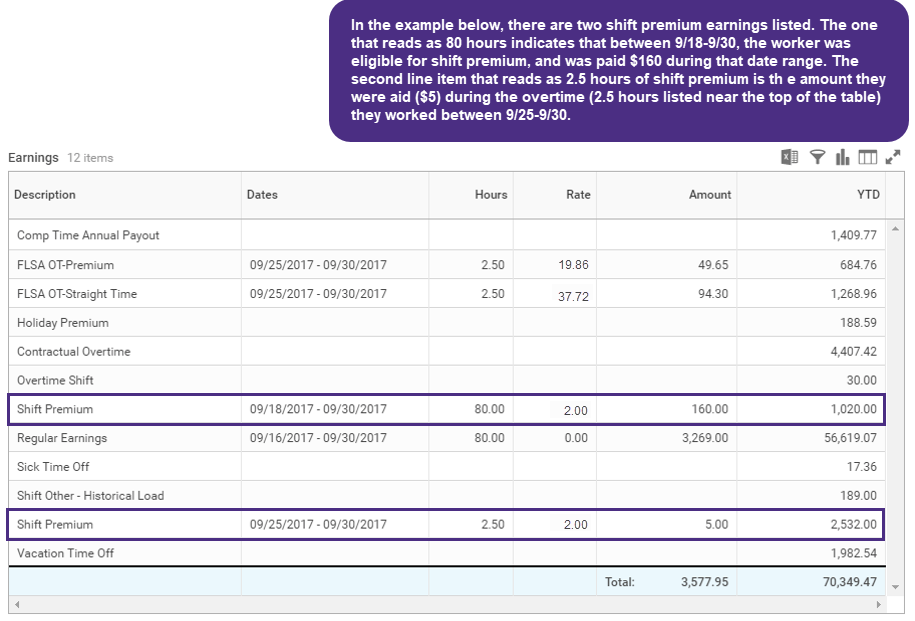

How To Read Your Payslip Integrated Service Center

Payroll Tax Calculator For Employers Gusto

Hrpaych Yeartodate Payroll Services Washington State University

How To Do Payroll In Excel In 7 Steps Free Template

How To Read Your Payslip Integrated Service Center

Here S How Much Money You Take Home From A 75 000 Salary

What Are Marriage Penalties And Bonuses Tax Policy Center

Pay Calculator

How To Do Payroll In Excel In 7 Steps Free Template

Esdwagov Calculate Your Benefit

How To Read Your Payslip Integrated Service Center

Washington Paycheck Calculator Adp

Hourly Paycheck Calculator Calculate Hourly Pay Adp

Ytd Calculator Calculate Your Year To Date Income